oregon workers benefit fund tax rate

The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to each employee. Color-coded maps of the US.

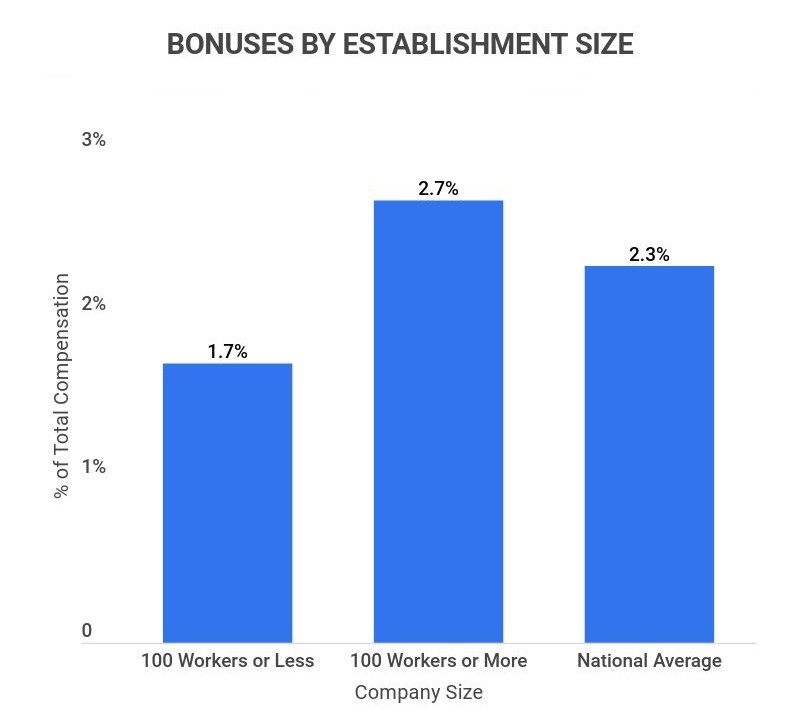

What Is The Average Bonus Percentage 2022 29 Facts And Statistics About Bonuses Zippia

The Oregon Worker Benefit Fund OR WBF is an hourly tracked other tax that is different from Oregon Workers Compensation.

. The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased. Employers and employees split the cost evenly. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers.

Oregon workers benefit fund tax rate Saturday June 18 2022 Edit. If you are an Oregon employer and carry workers compensation insurance you must pay a payroll tax called the Workers Benefit Fund WBF Assessment for each employee covered under. In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment.

In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers owners and officers covered by workers compensation. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged from 2021.

In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. Workers Benefit Fund assessment. Oregon Workers Benefit Fund Payroll Tax Overview.

Wwwdcbsoregongov Testimony of DCBS Director Our Mission. It is automatically added by payroll but requires. Go online at httpswww.

Oregon workers compensation costs already among the lowest in the nation will drop in 2022 for the ninth-straight year. What is the Oregon WBF tax rate. Workers Benefit Fund - Oregon.

You are responsible for any. Oregon Workers Benefit Fund Payroll Tax Overview. You are responsible for any.

The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to each employee. To protect and serve Oregons consumers and workers while supporting a positive business climate Workers. For 2022 the Oregon Workers Benefit fund rate remains at 22 cents per hour worked in 2022.

Workers Benefit Fund - Oregon. You are responsible for any. Prescribe the rate of the Workers Benefit Fund assessment under.

Ranking of each states workers. Prescribe the rate of the Workers Benefit Fund assessment under ORS 656506. The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers.

Workers Benefit Fund Assessment Oregon Administrative Rules Chapter 436 Division 070 Effective Jan. Oregon Workers Benefit Fund Payroll Tax Overview. For 2019 our analysts.

3 Workers Benefit Fund WBF Assessment Important information The 2022 Workers Benefit Fund WBF assessment rate is 22 cents per hour.

Oregon Workers Compensation Division Do I Need Insurance Employer State Of Oregon

Workers Compensation Overview And Issues Everycrsreport Com

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

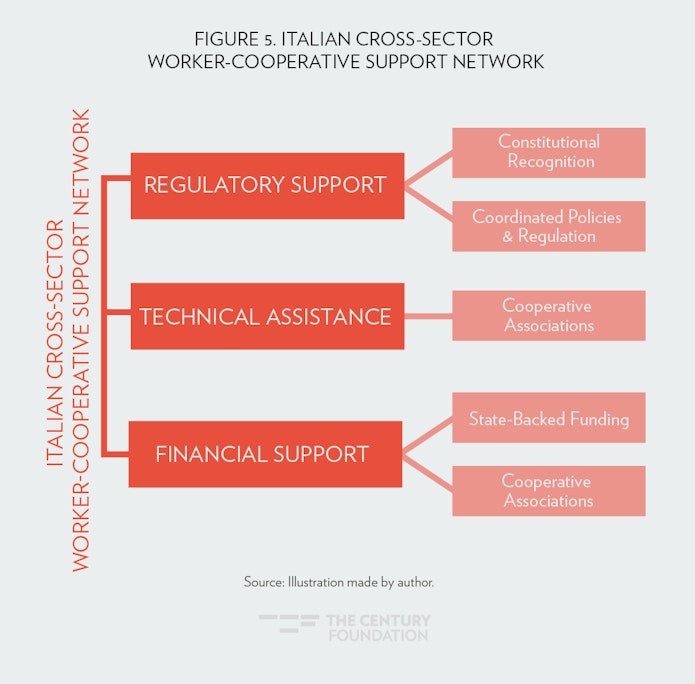

Reducing Economic Inequality Through Democratic Worker Ownership

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

How Are Workers Compensation Benefits Calculated Foa Law

Taxable Non Taxable Benefits Definition Examples Video Lesson Transcript Study Com

A New North Star Business Council Of Canada

Oregon Workers Benefit Fund Wbf Assessment

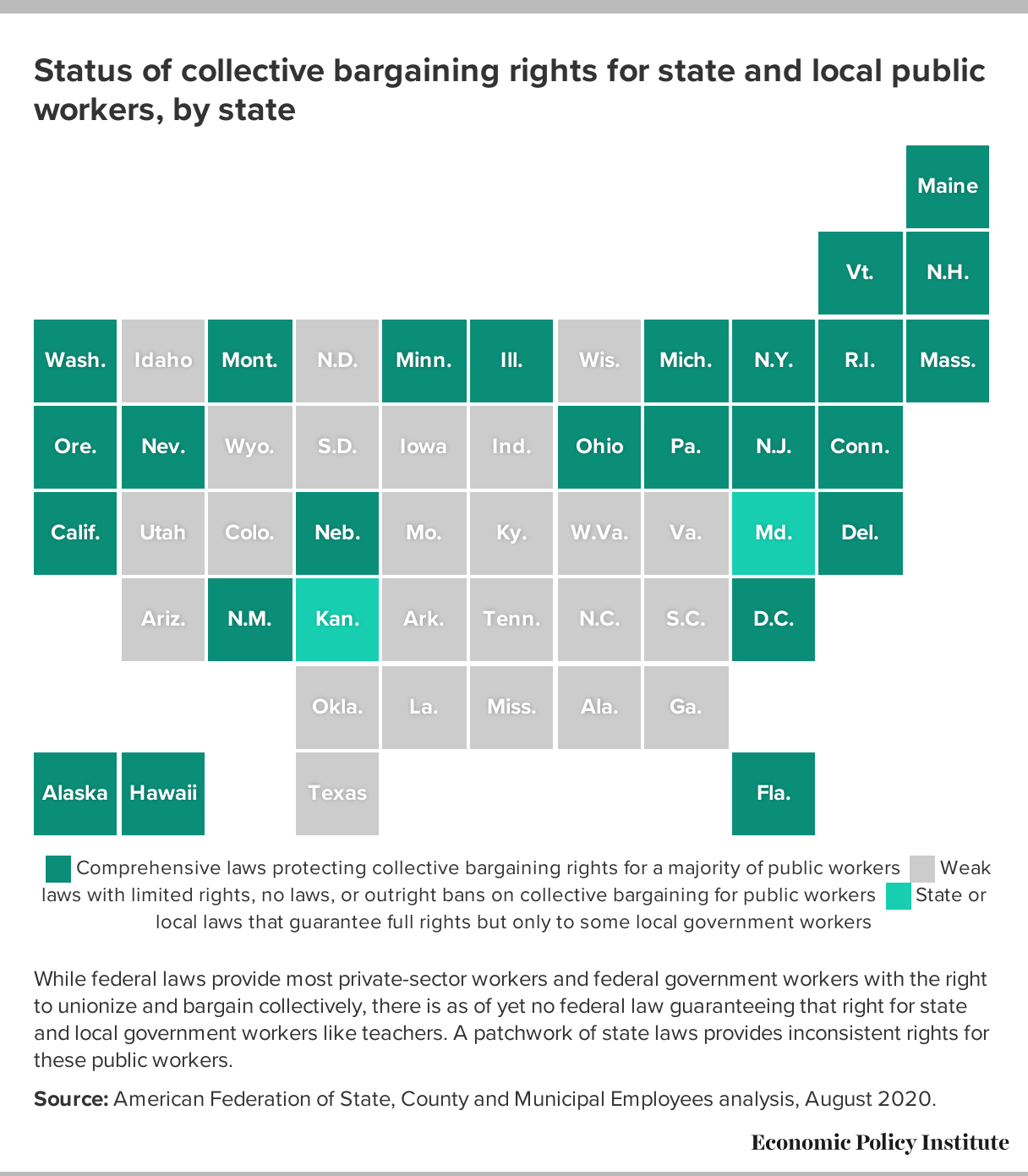

How Today S Unions Help Working People Giving Workers The Power To Improve Their Jobs And Unrig The Economy Economic Policy Institute

How Are My Workers Compensation Benefits Calculated Kbg Injury Law

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Workers Compensation Benefits And Your Taxes 2022 Turbotax Canada Tips

Why Unions Are Good For Workers Especially In A Crisis Like Covid 19 12 Policies That Would Boost Worker Rights Safety And Wages Economic Policy Institute